The Gulf’s Entrepreneurial Pulse: Believe, Risk, Gender & Status

Entrepreneurship in the Gulf isn’t a side hustle anymore. It’s the headline act, baked into national strategies, stitched into identity, carrying the weight of diversification. But behind the big talk of unicorns and reforms sits something quieter, more human: what people believe, what they fear, and how society decides to treat those who try.

For nearly two decades, the Global Entrepreneurship Monitor (GEM) has been tracking these undercurrents. Seven signals, seven lenses, together they show us how Saudis, Emiratis, and Qataris are rewriting the script on what it means to build in the Gulf

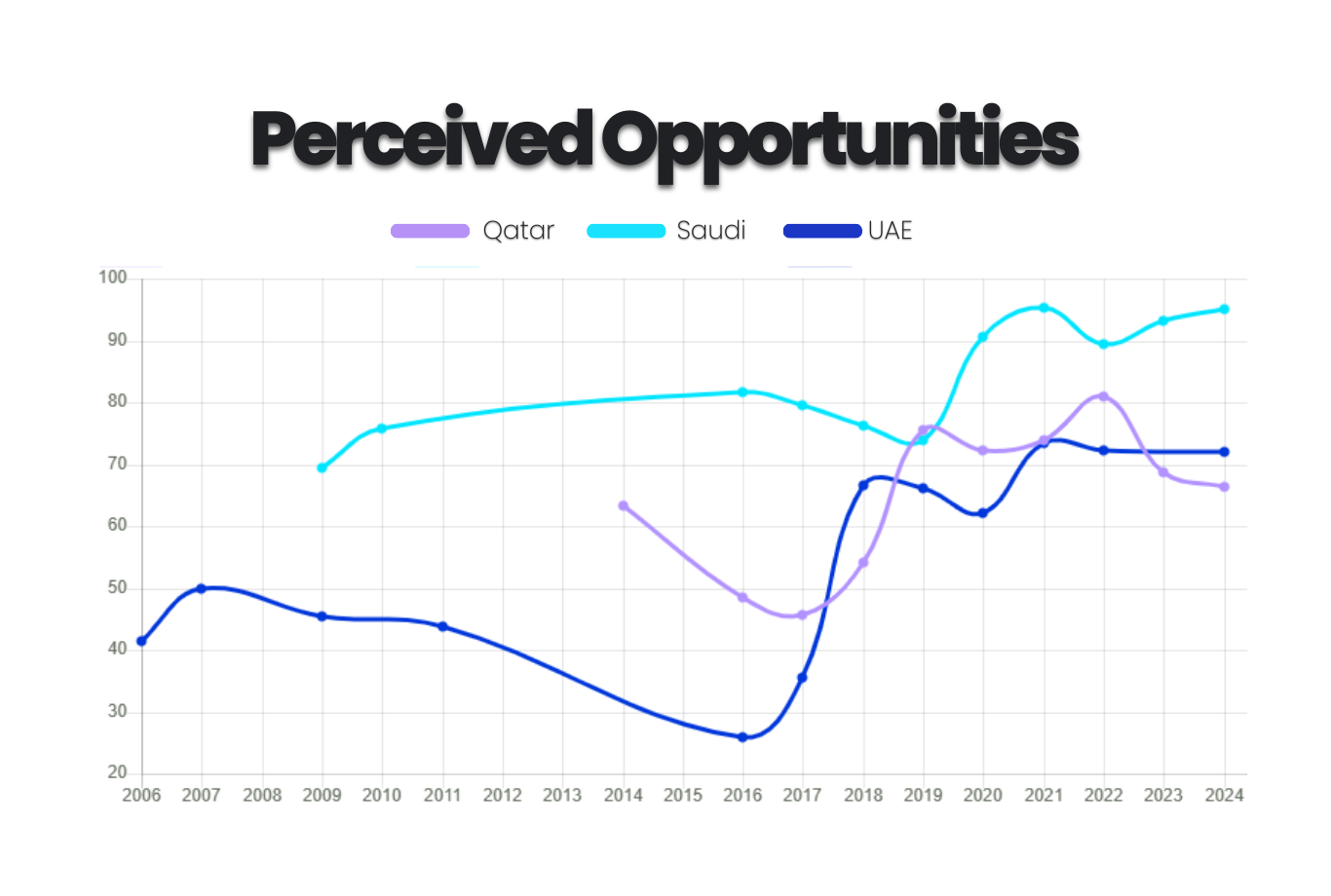

1. Perceived Opportunities

What it measures: The percentage of people who see real opportunities to start a business where they live.

Why it matters: You can build all the incubators and sprinkle tax breaks, if people don’t see opportunity, they stay where they are.

Insights:

Saudi Arabia: From 2023 data, nearly 9 in 10 adults believe there are good local opportunities. GEM Global Entrepreneurship Monitor That’s huge. It reflects how Vision 2030 and diversification policies are shifting culture.

UAE: The country scored #1 globally in the latest GEM rankings for ease of starting and operating ventures. Ministry of Education NECI (National Entrepreneurial Context Index) recently hit record highs.

Qatar: In its 2024/25 national report, GEM shows Qatar maintaining strong confidence in local opportunity levels despite regional turbulence. qdb.qa called entrepreneurship “accepted and supported” socially.

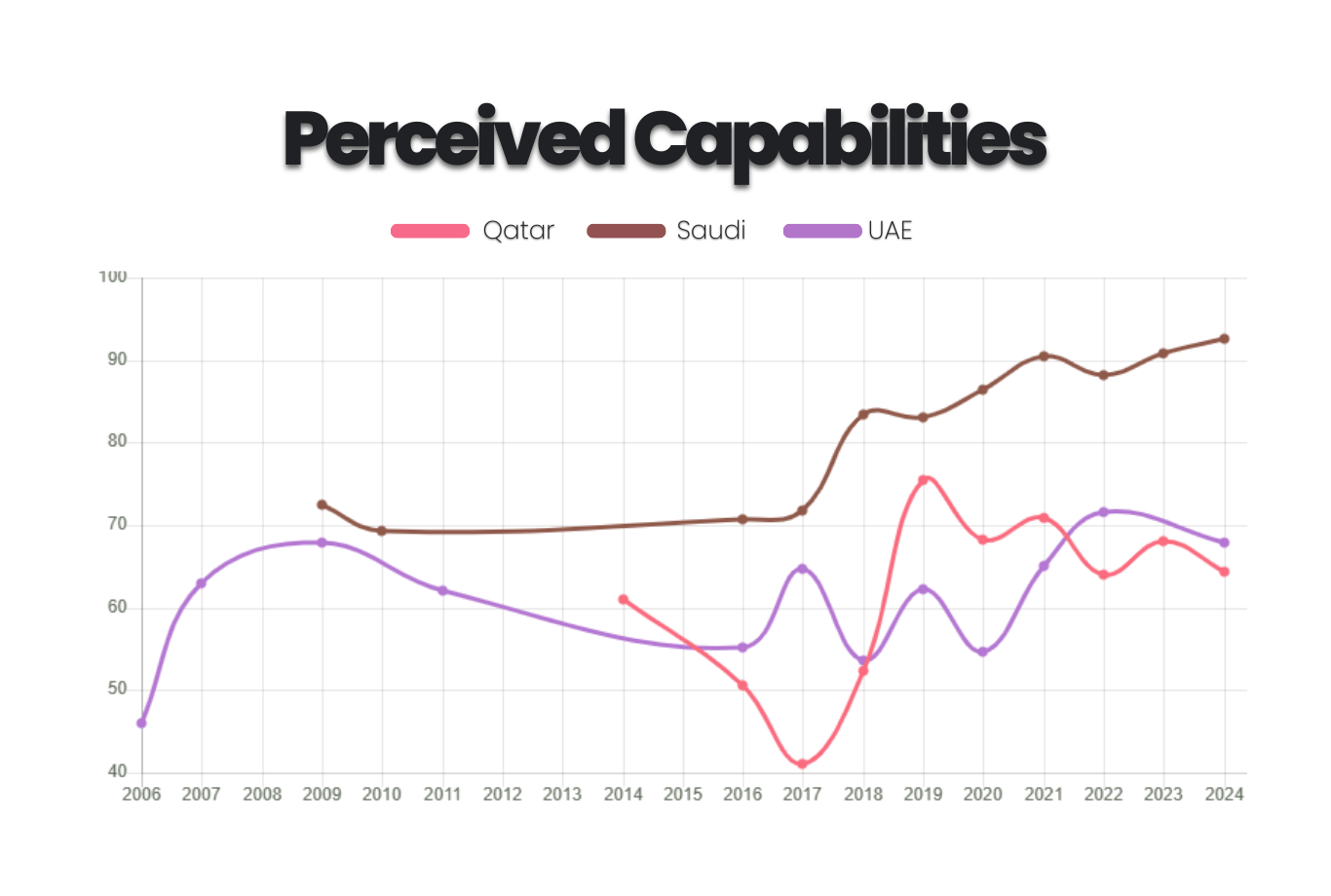

2. Perceived Capabilities

What it measures: Percent of people who believe they have the skills, knowledge, and experience to launch a venture.

Why it matters: Opportunity without belief is like a loaded gun with no one to pull the trigger.

Insights:

Saudi Arabia: People’s confidence is cottoning to the reforms. GEM notes soaring self-perceptions, many believe they can launch.

UAE: They consistently score very high in ecosystem conditions. Social support and access metrics show that individuals feel empowered.

Qatar: The national narrative is that ecosystem support plus education has bolstered confidence, though scaling remains a challenge.

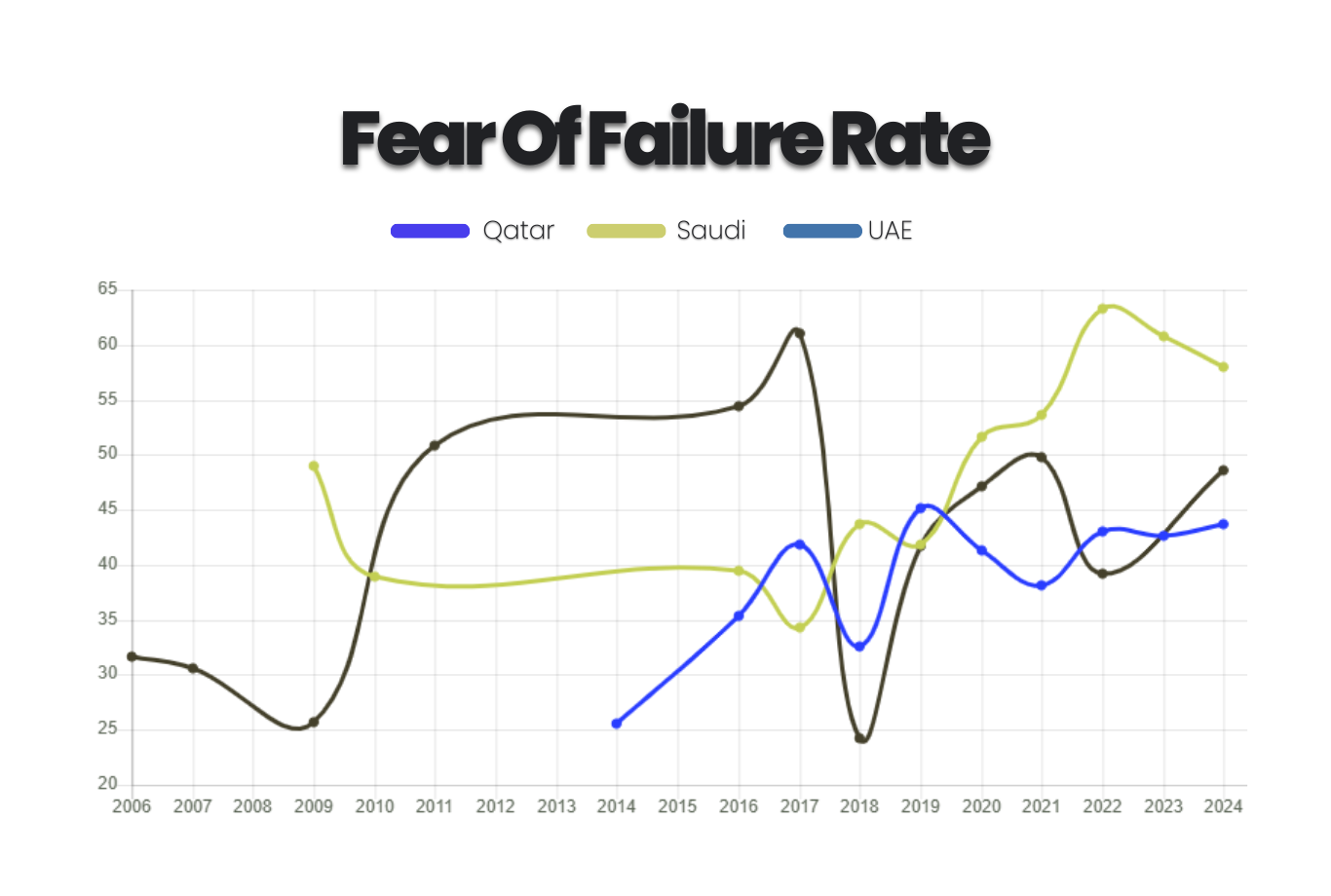

3. Fear of Failure

What it measures: Among those who see opportunity, how many say fear of failure would stop them from launching.

Why it matters: This is the silent killer. It’s not lack of money or policy, it's the voice in your head saying “you’ll fall.”

Insights:

Saudi Arabia: Even with optimism, more than 60% admit fear of failure would block them. That’s not a bug. It’s a tension: they’re sold on entrepreneurship, but scared of the fallout.

UAE: The stakes are high there. Business success ties into visas, prestige, and social standing, so the fear is sharper, cycles of hype and crash more frequent. Research comparing UAE, Qatar & Saudi finds such systemic “social cost of failure” more intense in UAE. ResearchGate

Qatar: Safer ground. Fear exists, but socially, failure doesn’t carry as much shame. The cultural cost is lower, so trying again is easier. That’s a quiet edge.

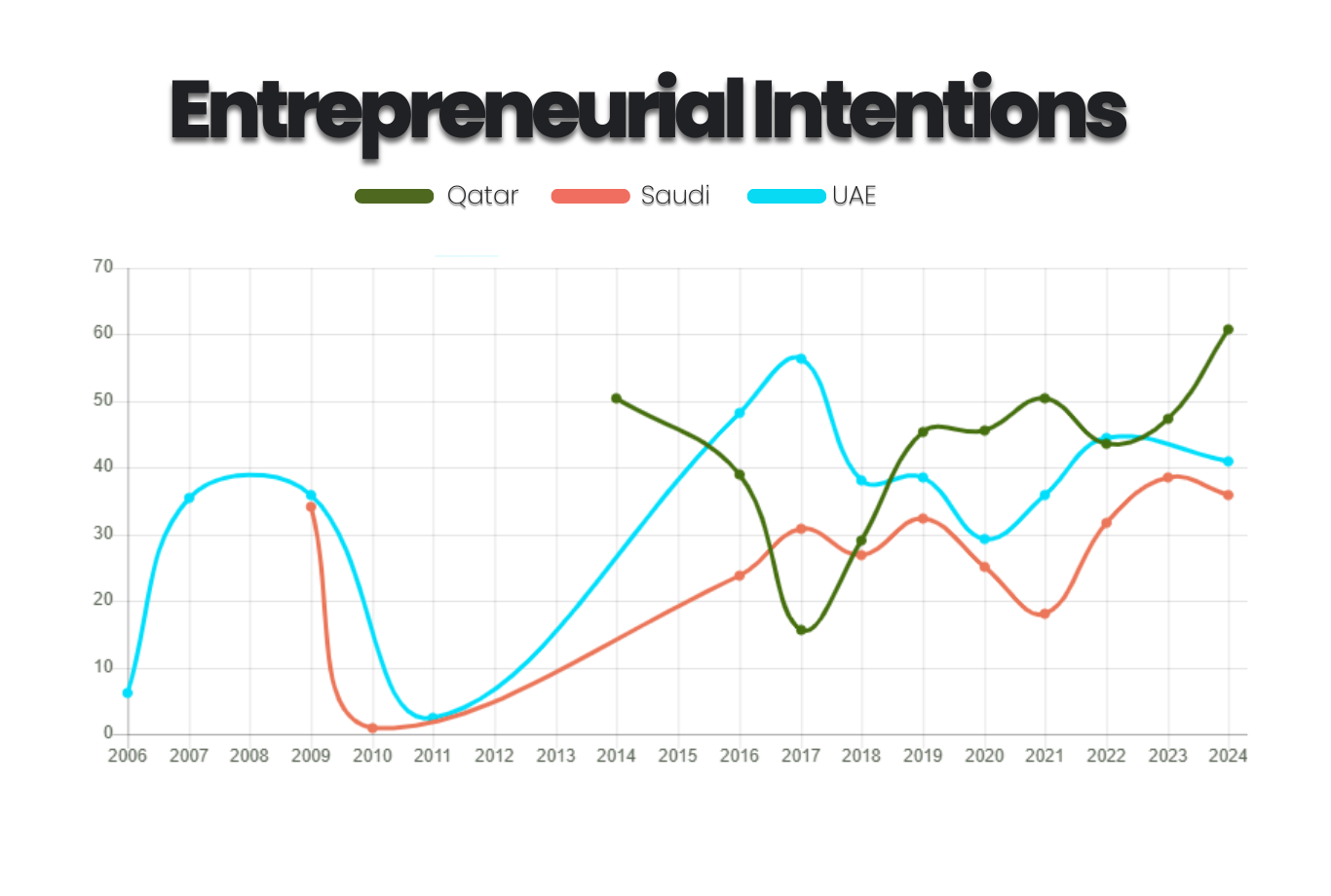

4. Entrepreneurial Intentions

What it measures: Share of people (not in business yet) who intend to start within 3 years.

Why it matters: Intentions are the seeds. Ecosystem health is shown in how many are ready to cultivate.

Insights:

Saudi Arabia: Intent has climbed steadily. People aren’t just talking, they’re planning. GEM shows ~40% of non-entrepreneurs intend to start.

UAE: Intent levels are strong and stable. Backed by infrastructure, business-friendly laws, and visibility.

Qatar: Intentions are more volatile, surges in good years, dips in uncertain years. That volatility translates to unpredictable pipelines.

5. Female/Male TEA Ratio

What it measures: Women’s early-stage entrepreneurial activity relative to men’s (TEA = new + nascent ventures).

Why it matters: Gender parity isn’t optional, it’s economic sanity. You cut out half the talent at your own risk.

Insights:

Saudi Arabia: The gender gap swings heavy. In earlier GEM reports, men’s TEA was ~12.9% vs women’s ~9.7%. Reform waves help, but gaps persist. Wamda

UAE: They’ve made progress. Female participation climbs gradually, through supportive policies, women-focused acceleration, and ecosystem inclusion.

Qatar: The ratio bounces, but women remain a visible force in early entrepreneurship. In national reports, Qatar ranks first in NECI partly due to inclusive perceptions.

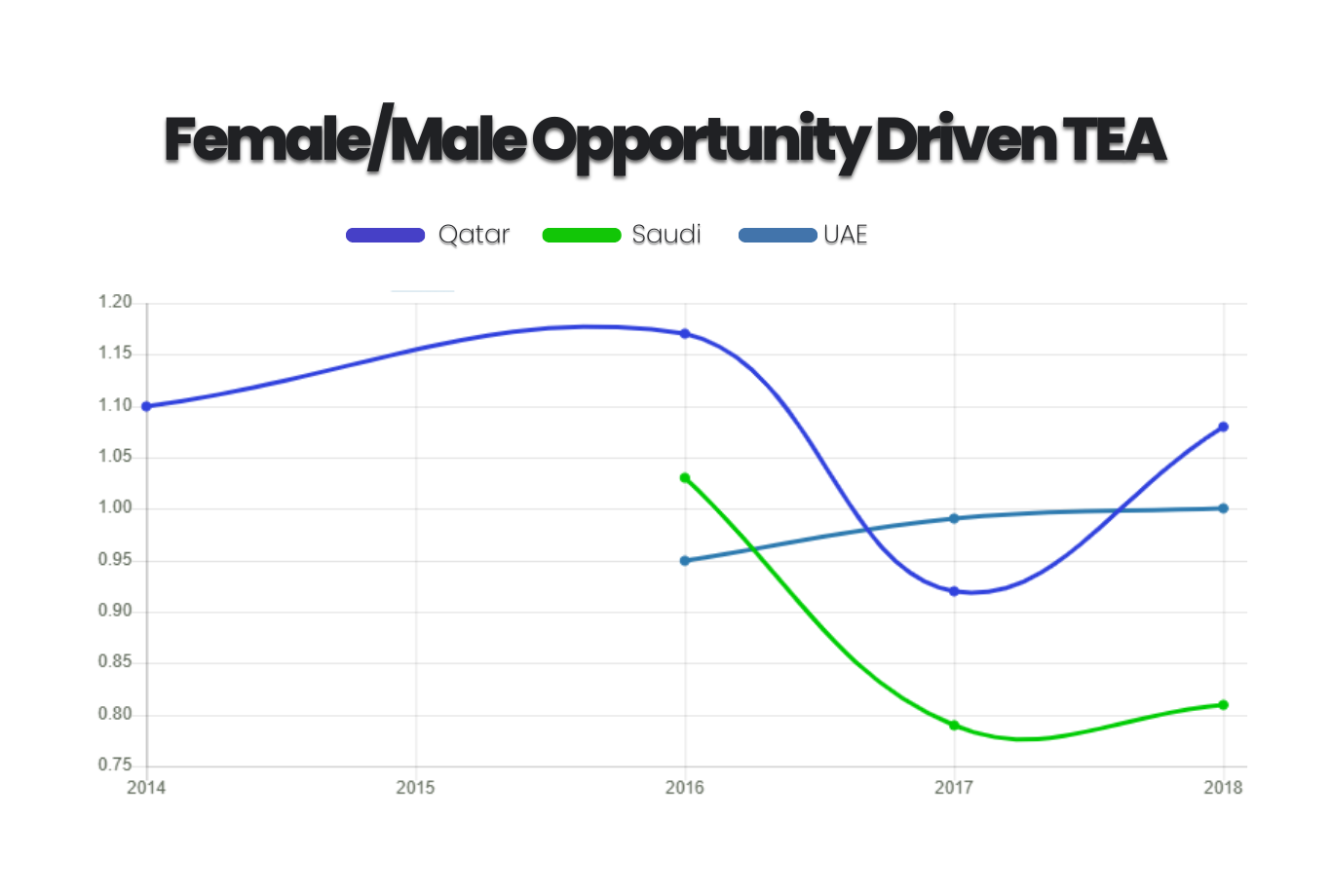

6. Female/Male Opportunity-Driven TEA Ratio

What it measures: Whether women’s businesses are opportunity-driven (not necessity-driven) relative to men.

Why it matters: Necessity startups often stay small. Opportunity-driven ventures scale. When women lead on opportunity, the game changes.

Insights:

Saudi Arabia: In 2016, ~92% of startups were opportunity-motivated.But structural barriers (finance, networks) still skew women more toward necessity in hard times.

UAE: Close to parity here. Women aren’t just launching; many are launching with ambition. That’s ecosystem maturity.

Qatar: Early periods saw women outperform men in opportunity-driven TEA. But dips happen during shocks or capital constraint years.

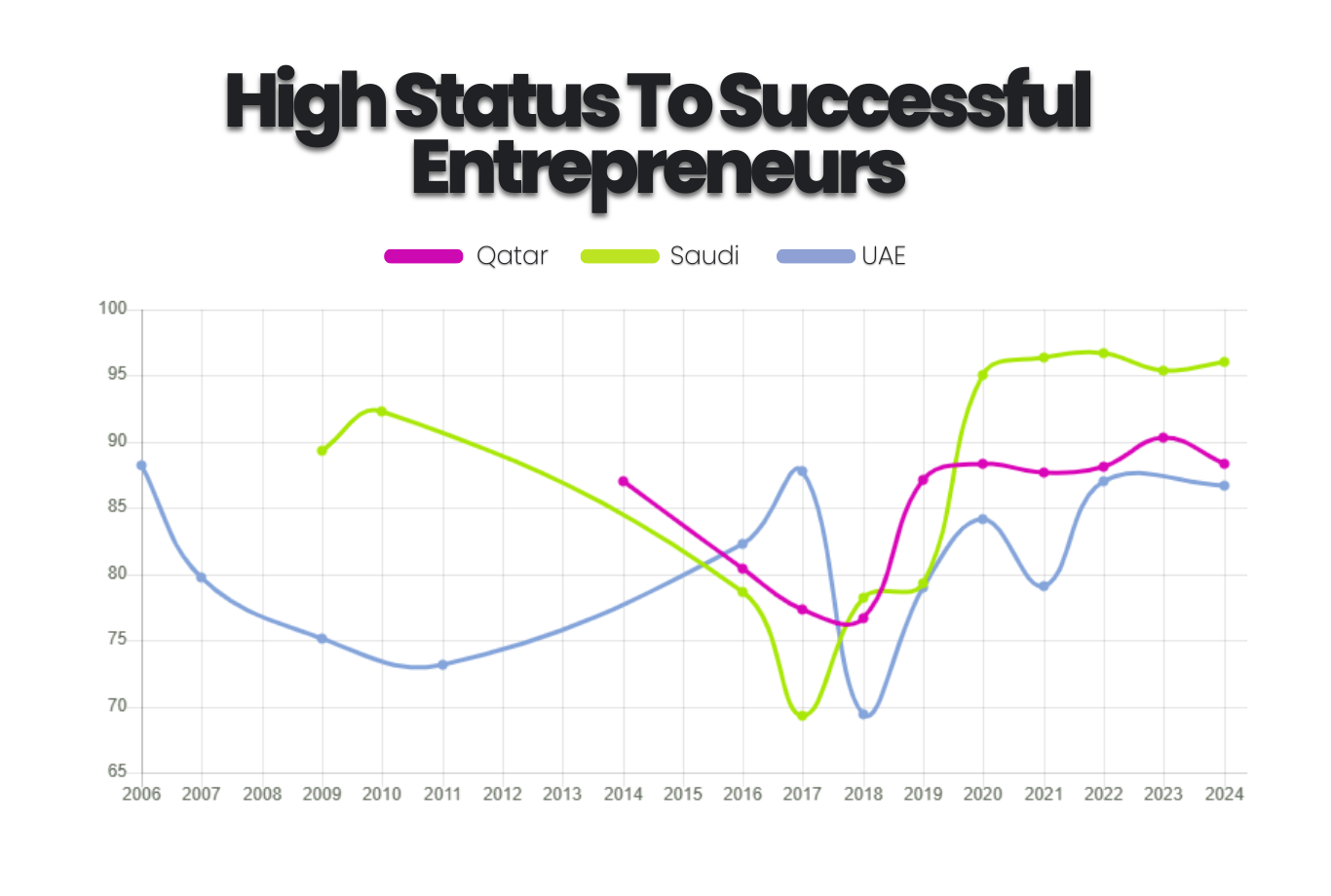

7. High Status to Successful Entrepreneurs

What it measures: How many believe successful founders enjoy high social status in their society.

Why it matters: Respect is currency. When society idolizes founders, more people consider the risk worth it.

Insights:

Saudi Arabia: The narrative flipped around 2018. Soon, >95% believe entrepreneurs are high-status. This aligns with national messaging that makes entrepreneurship patriotic.

UAE: Cycles of hype can distort perception. But recent GEM data shows continued rise in status across youth, media, policy.

Qatar: More steady climb — status rises, but without the hype bursts. Entrepreneurs are respected, but not necessarily glorified.

Closing: The Gulf’s Next Chapter Is Cultural, Not Just Capital

These charts aren’t just metrics, they’re the region’s bones, muscles, and nerve endings in motion.

Saudi Arabia is building an entrepreneurial identity, but still battling fear and volatility. The UAE has built a powerful machine, high trust, high stakes, high exposure. Qatar quietly optimizes: less hype, lower shame, more breathing room for failure and comeback.

The future of Gulf economies doesn’t belong to governments, or investors, it belongs to people who believe, risk, and then build.

🤔 You see this too? In your circle, your country, your mindset? Let me know, where is belief strong, where is fear heavy?

Tag someone in your network who’s locked in on this shift, let’s widen the circle.

♻️ If this pushed something in you, share it forward, maybe it’s the spark someone’s waiting for.

If you’re ready to go deeper, to map strategy to culture, to unlock trust, to see how entrepreneurship shifts identity, not just economies, I’d love to talk and If this hit home, you’ll love our weekly Monday drop, real, bold, unfiltered, practical and actionable conversations, straight to your inbox. Sign Up Today