Saudi’s Real Estate Reset: A New Era for Developers, Investors, and Global Capital

The Kingdom made a move this week that will ripple for decades. The Real Estate General Authority | الهيئة العامة للعقار announced a new law amendment that allows foreign individuals, international companies, and publicly listed firms to own residential, commercial, and investment property across most of Saudi Arabia.

Makkah and Madinah remain the exception, limited to use-based rights for Muslim individuals only, but everywhere else? The door is wide open.

This isn't just a policy update. It's a power move. A reset. A signal to the world that Saudi Arabia is serious about its Vision 2030 commitments, diversifying the economy, magnetizing capital, and inviting the world to not just visit, but invest.

The Market Today, and the One Were Building

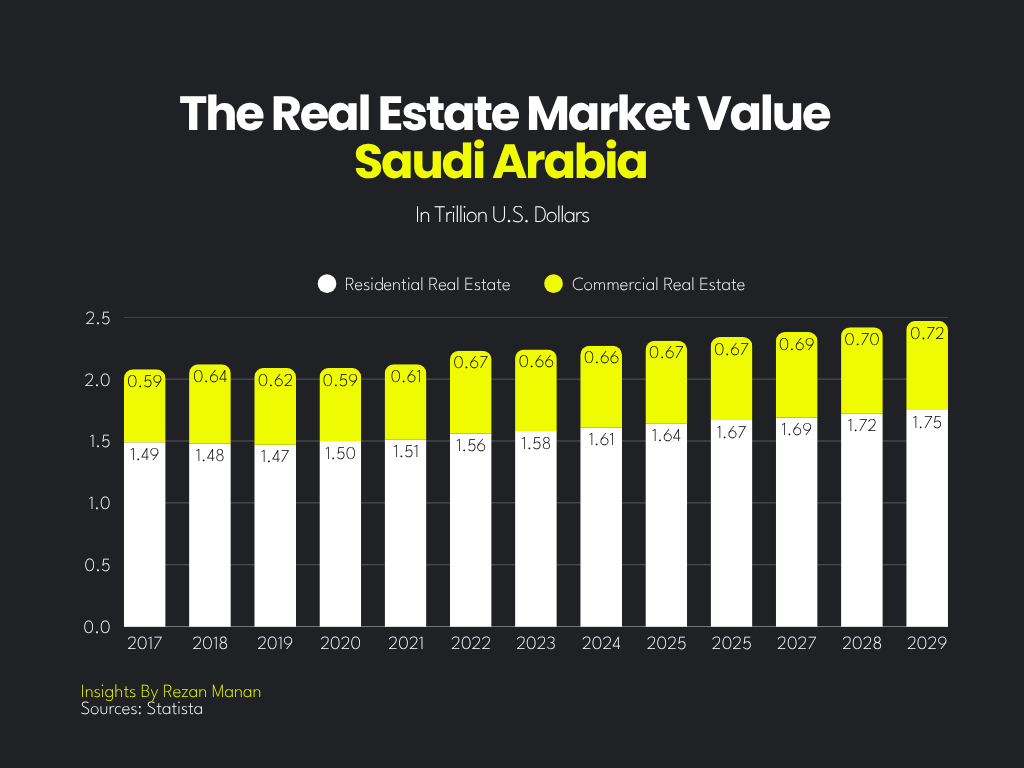

Let’s break it down with numbers, right now:

Saudi’s residential real estate market is valued at ~USD 42B (2024)

That number is expected to hit USD 66B by 2030 (CAGR ~7.9%)

The total real estate market, including commercial, is hovering at USD 72B and projected to climb past USD 132B by 2033

In Q1 2025 alone:

Mortgage lending jumped 28.3% YoY

Residential property prices rose 5.1% nationally

Riyadh soared by 10–11% in some segments

That surge in demand isn’t abstract, it’s in the data. Now add foreign demand to that fire? We’re not just talking linear growth. We’re talking lift-off.

What Foreign Ownership Could Unlock

We’ve seen this play out before in the Gulf. When the UAE opened its doors in the early 2000s, foreign buyers reshaped the skyline.

Today in Dubai, foreign nationals own an estimated 43% of all residential value. Property sales jumped from USD 98B in 2020 to USD 121B in 2022, and those were just the early innings. Real estate now contributes about 10% of Dubai’s GDP.

This new Saudi law could do the same. With foreign capital, we’ll likely see:

A surge in demand for luxury and branded residences, where the Middle East is already leading the global charge.

More liquidity across residential and commercial stock

New freehold zones, international investment corridors, and next-gen smart developments

An influx of developers, brokers, REITs, and institutional buyers setting up shop inside the Kingdom

If foreign capital contributes just 10–20% of total growth, we’re looking at a total market value of USD 100–120B by 2030, well above current forecasts.

A Glimpse at the UAE’s Playbook

What Saudi just did is bold, but not unprecedented. The UAE paved the way:

In 2019, it allowed 100% foreign ownership of real estate firms

Since then, Dubai’s real estate sector became one of the world’s most globally integrated

Investors from Europe, Asia, and the U.S. now hold significant slices of the city’s premium inventory

And off-plan launches? Fully booked in hours

The blueprint is there. Saudi is simply scaling it, with more land, more ambition, and a demographic tailwind that makes every developer's heart race.

The Ripple Effects: Beyond Bricks and Mortar

This move won’t just touch developers and brokers. It will send shockwaves through:

Construction: A new wave of demand means more projects, more materials, more jobs

Finance: Increased mortgage activity, new REITs, securitization tools, and global fund interest

Tech: Smart buildings, proptech platforms, AI-powered tenant management, and digital land registries will grow fast

Legal & Compliance: Entire ecosystems will emerge to manage foreign due diligence, regulatory frameworks, and cross-border tax complexity

Tourism: Foreign homeowners become long-term visitors, spenders, and story-spreaders

This is a market-wide multiplier. Not a trickle. A flood.

What This Means for Corporates Storing Cash in Concrete

Real estate isn't just for homeowners and developers. It's also the quiet darling of the balance sheet for major corporations. Look at what’s happening in Dublin:

Google, Facebook (Meta), Amazon, Microsoft have poured billions into Irish real estate, not just for offices, but for long-term strategic holdings

Why? Real estate offers capital preservation, rising value, and stable income

Big Tech, Private Equity, Sovereign Wealth Funds, they all love real estate. And when a new market like Saudi Arabia opens up with clear rules, high growth, and visionary urban planning. Expect a wave.

We’ll see:

Corporate regional HQs in Riyadh and NEOM

Investment arms diversifying into Saudi property portfolios

Global funds forming Saudi-specific SPVs and JVs with local developers

High-end commercial and retail assets snapped up as long-hold plays

This move just turned Saudi Arabia into a magnet for strategic capital, the kind that doesn’t flip fast, but builds deep roots.

What This Means for Developers, Brokers, and the Advertising Ecosystem

This law doesn't just change who can buy, it changes how properties are marketed, sold, and experienced.

For real estate developers and brokerage firms, the shift is monumental. Until now, the focus has largely been local-to-national. But with foreign buyers entering the scene, the marketing lens must zoom out, regional and global reach becomes non-negotiable.

Here's what changes:

Branding: Developers now need internationally resonant brand identities. It's no longer enough to appeal to a domestic buyer, you're speaking to Berlin, Mumbai, London, and Kuala Lumpur.

Digital Sales Infrastructure: Think 3D tours, multilingual landing pages, WhatsApp for Business, and global CRM systems. Buyers won't fly in for viewings. The deal will happen online.

Social and Search Ads:

In 2024, the Middle East real estate sector spends ~$400M/year on digital advertising (mostly concentrated in UAE).

With Saudi opening up, this figure is expected to grow 30–40% YoY for the next five years, potentially crossing $1B by 2028.

Platforms like Meta, Google, TikTok, and LinkedIn will become primary sales channels, not just brand awareness tools

Pillars for Developers & Brokers to Power Up:

Global Ad Targeting, Geo-specific campaigns aimed at GCC expats, international investors, and diaspora buyers

Localized Content, Arabic + English at minimum, but also Mandarin, Urdu, and Russian where strategic

End-to-End Digital Sales Funnel, From discovery to deal: lead forms, retargeting, virtual viewings, digital KYC

Partnerships with Global Agencies, Local agencies must partner up or level up to meet international standards

SEO & Thought Leadership, Content that educates and ranks: "How to buy in Saudi as a foreigner" will soon be a high-intent keyword

Data & Attribution, Real estate can't afford to fly blind. CRM integrations and pixel tracking will separate serious players from the rest

Final Word

Saudi Arabia is not playing it safe. It's playing for legacy. Opening real estate to foreign ownership is a declaration: “We’re ready. Come build with us.”

By 2030, this won't just be a new law. It’ll be the reason new cities rise, new fortunes are made, and global capital finally flows where it long wanted to go.

And if you're in real estate, finance, tech, or construction? Now’s not the time to wait and watch. Now’s the time to move.

🤔 What does Saudi’s real estate shift mean for your business strategy?

💬 Drop your thoughts in the comments, what excites you, what concerns you, and what you’re watching closely. I’d love to hear how this lands from where you sit.

📌 Know someone who works in real estate, finance, or expansion strategy? Tag them. Let’s keep this conversation moving across boardrooms and borders.

♻️ If this gave you something to think about, share it forward. The region is changing fast, your network deserves to stay ahead of it too.

If you’re navigating real estate strategy, market entry, or growth across the Middle East and North Africa, let’s talk, and If this hit home, you’ll love our weekly drop braking down the big and important shifts in the region, straight to your inbox. Sign Up Today