2025 Advertising Trends & Insights: Worldwide, Europe & MENA

This week article is for the business leaders, marketers, and decision-makers who want to stay ahead of the game. This time we’re diving deep into the biggest advertising trends of 2025, breaking down key insights, must-know stats, and strategic moves that will help you maximize your ad spend and drive real results.

Here’s what we’re covering:

2025 Trends and Insights, Worldwide View

2025 Trends and Insights, Europe View

2025 Trends and Insights, MENA View

Why Business Leaders and Marketers Should Care

How Business Leaders and Marketers Can Benefit

A close look at Ireland, UAE, Saudi Arabia, Qatar, or South Africa Markets

If you’re ready to future-proof your strategy, grab your coffee ☕ and let’s dive in!

Intro & Highlights

Advertising isn't just about selling, it’s about storytelling, connection, and influence. In a world where attention spans are shorter than ever, brands that master the art of advertising don’t just get noticed; they get remembered. However, the dynamics of advertising vary across regions. Let's delve into the global landscape and then shed light on specific regions and Markets to uncover key insights.

The future of advertising is digital-first, AI-powered, and programmatic-driven. Brands that master omnichannel engagement will own the global market.

Europe’s advertising industry is rapidly evolving, with 72% of budgets now flowing into digital channels. Social commerce, AI-driven campaigns, and CTV are reshaping brand engagement.

MENA’s advertising market is experiencing a digital revolution, with 66% of ad spend now dedicated to online platforms. The region is mobile-first, influencer-driven, and growing at an unprecedented pace.

2025 Trends and Insights, Worldwide View

The worldwide advertising industry is undergoing a rapid transformation, with digital advertising continuing to dominate, mobile usage skyrocketing, and programmatic buying becoming the preferred method of ad placement. Below are the most up-to-date insights for 2025.

With 74% of ad spend shifting to digital, the world is embracing a mobile-first, data-driven ad ecosystem where personalization is king.

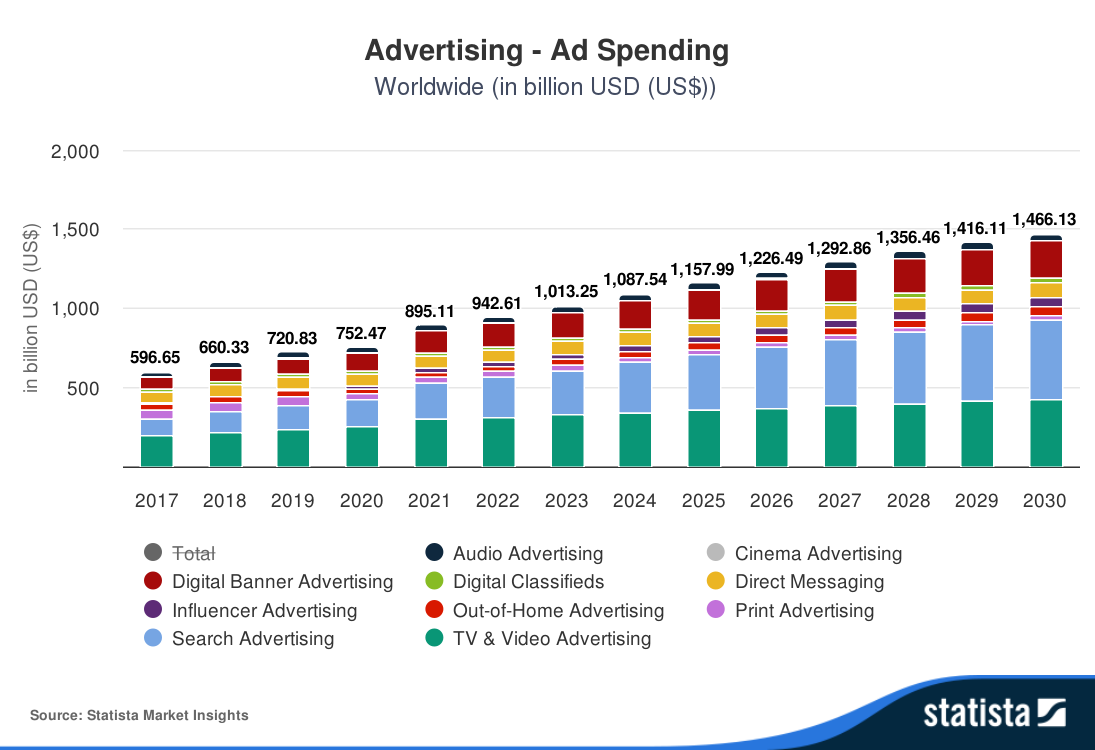

Advertising Spend Channels (Worldwide, 2025):

Digital Advertising: Expected to account for 71% of total global ad spend, largely driven by social media, search, and video ads.

Television & Video Advertising: Holding 19% of total ad spend, but increasingly influenced by the rise of on-demand subscriptions such as Netflix, Disney+, and region-specific streaming platforms.

Out-of-Home (OOH) Advertising: Projected to maintain a 7% share, with digital billboards and transit advertising leading growth.

Top Digital Ad Spend Types (2025):

Search Advertising: Will hold 44% of total digital ad spend, remaining a key driver of conversions.

Display & Video Ads: Expected to reach 38%, fueled by short-form video and CTV expansion.

Social Media Ads: Projected at 23%, with a strong focus on interactive, influencer-led, and user-generated content.

Rising Channels:

Programmatic Advertising: Expected to account for 82% of all digital ad transactions, as automated, data-driven advertising becomes the standard.

Connected TV (CTV) & Streaming Ads: Growing at 25% YoY, as brands shift budgets from traditional TV to CTV platforms and ad-supported video-on-demand (AVOD).

Influencer Advertising: Steadily growing at a rate of 10% YoY, and projected to reach $60.2 billion by 2030.

Retail Media Networks: Sponsored ads on platforms like Amazon, Walmart, and Alibaba will capture 18% of total digital ad spend, fueled by e-commerce growth and consumer shopping behavior shifts.

Social Media Spend Share:

Social media remains a dominant force in digital advertising, capturing 45% of total digital ad spend worldwide, with TikTok, Instagram, Facebook, and LinkedIn leading in engagement.

In-App vs. Mobile Web Advertising:

In-App Advertising will dominate mobile spend, accounting for 63%, driven by high engagement rates in gaming, social, and lifestyle apps.

Mobile Web Advertising will hold 29%, mainly used for display, search, and programmatic ads.

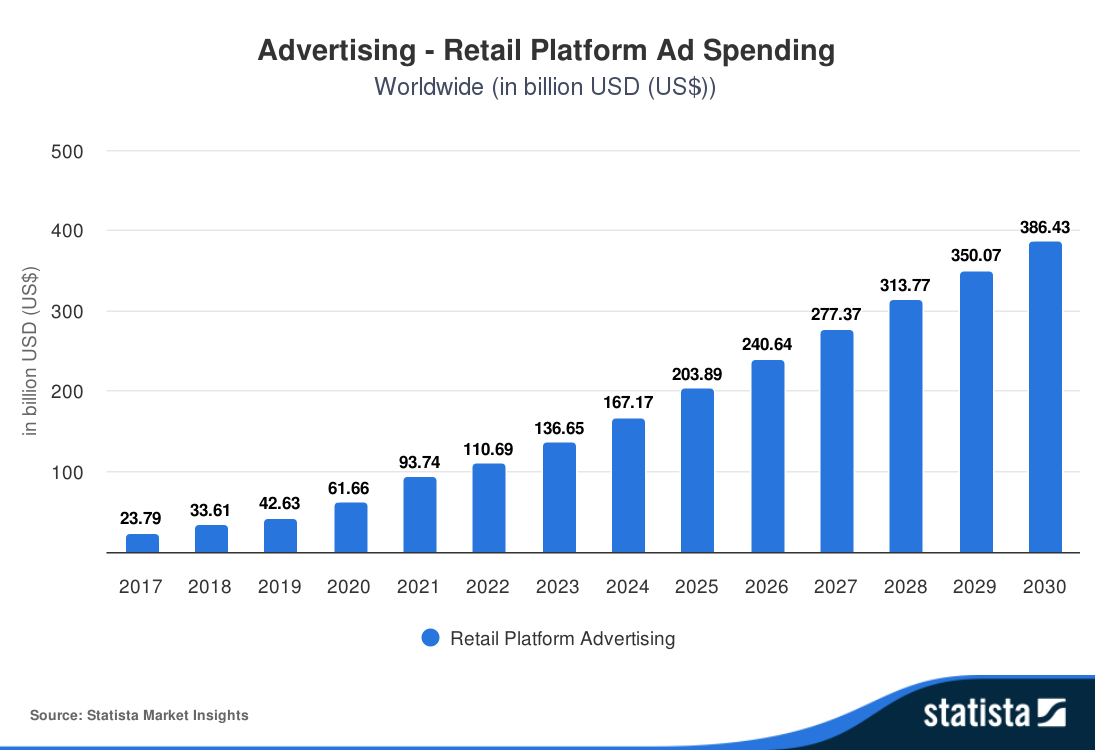

Retail & E-commerce Advertising Growth:

Retail Media & E-commerce Advertising is projected to grow 36% YoY, as brands prioritize online shopping platforms.

E-commerce advertising will represent 24% of total digital ad spend, with continued investment in Amazon, Shopify, Alibaba, and region-specific marketplaces.

Top Industries by Ad Spend (Worldwide, 2025):

FMCG & Retail (34%):The largest advertising sector, driven by high competition, frequent consumer purchases, and omnichannel marketing strategies. Brands invest heavily in social media, e-commerce, and influencer marketing to maintain visibility and drive sales.

Entertainment & Media; Pharma & Healthcare (8% each): The Entertainment & Media sector benefits from the growth of streaming platforms and digital content consumption, leading to increased investments in CTV, social video ads, and influencer collaborations. Meanwhile, Pharma & Healthcare is experiencing a surge in direct-to-consumer digital advertising, particularly in telehealth services and personalized healthcare solutions.

Financial Services, Telecommunications, Travel & Leisure (7% each): The Financial Services & Telecoms sectors are heavily focused on digital customer acquisition strategies, targeting mobile-first users for banking, investment apps, and 5G-related services. The Travel & Leisure industry is rebounding post-pandemic, emphasizing experience-driven marketing, personalized ads, and social media campaigns targeting younger travelers.

Media Breakdown:

Digital vs. Traditional: Digital will reach 74% of total ad spend, with traditional media further declining.

Mobile vs. Desktop: 67% of digital ads will be served on mobile devices, reflecting the continued shift toward mobile-first user experiences.

Reach & User Penetration:

Mobile Internet Users: Expected to reach 5.6 billion worldwide in 2025, making mobile the dominant digital advertising channel.

Internet Users: Global internet penetration will exceed 70%, emphasizing the importance of digital-first strategies.

Social Media Platforms: With projected 4.9 billion users globally, social remains the primary channel for brand engagement.

Streaming & CTV Platforms: Growing in user base, particularly in high-income and urban markets, further boosting the ad-supported video model.

The global advertising industry is becoming increasingly digital-first, mobile-driven, and programmatic-powered. With CTV, influencer marketing, and retail media networks seeing major growth, businesses that embrace AI-driven targeting, personalized content, and omnichannel marketing will be in the strongest position for long-term success.

2025 Trends and Insights, Europe View

The European advertising market is experiencing a digital revolution, with brands doubling down on mobile-first strategies, AI-powered personalization, and social commerce. As traditional media continues to decline, digital advertising is capturing a larger share of budgets, fueled by search, social, video, and retail media networks. Here’s what’s shaping the industry in 2025.

The European market is seeing a sharp shift towards programmatic advertising, with 80% of all digital transactions now automated for precision targeting.

Advertising Spend Channels (Europe, 2025):

Digital Advertising: Expected to dominate 68% of total ad spend, led by search, display, and social media ads.

Television & Video Advertising: Holding 21% of the market, with brands increasingly investing in Connected TV (CTV) and ad-supported streaming platforms.

Out-of-Home (OOH) Advertising: Maintaining a 7% share, as digital billboards, transit ads, and DOOH (Digital Out-Of-Home) gain traction in urban markets.

Top Digital Ad Spend Types (2025):

Search Advertising: Holding 42% of total digital ad spend, continuing to deliver high-intent conversions.

Social Media Ads: Expected to reach $58.21 billion, accounting for 25% of digital ad spend, with Instagram, TikTok, and LinkedIn leading engagement.

Display & Video Ads: Projected at 36%, powered by the rise of short-form videos and the growing popularity of CTV ads.

Rising Channels:

Programmatic Advertising: Expected to account for 80% of all digital transactions, with AI-driven bidding, real-time personalization, and first-party data strategies taking center stage.

Connected TV (CTV) & Streaming Ads: Growing at 22% YoY, as brands shift budgets from traditional TV to ad-supported video-on-demand (AVOD) services like Netflix, DAZN, and YouTube.

Influencer Advertising: Growing at 12% YoY, with European brands prioritizing micro and nano-influencers for higher engagement and authenticity.

Retail Media Networks: Sponsored ads on Amazon, Carrefour, Zalando, and Tesco will capture 16% of total digital ad spend, fueled by shifting consumer shopping habits and the growth of first-party data

Social Media Spend Share:

Social media remains a powerhouse in digital advertising, making up 25% of digital ad budgets across Europe. Meta platforms (Facebook & Instagram) continue to lead, while TikTok’s short-form video dominance and LinkedIn’s B2B advertising growth make them key players in 2025.

In-App vs. Mobile Web Advertising:

In-App Advertising: Expected to capture $45.53 billion, dominating 61% of mobile ad spend, thanks to high engagement rates in gaming, social, and shopping apps.

Mobile Web Advertising: Retaining 31%, mainly used for search, display, and programmatic ads.

Retail & E-commerce Advertising Growth:

Retail Media & E-commerce Advertising is projected to grow 34% YoY, as European brands shift ad spend from traditional media to online marketplaces.

E-commerce Advertising will represent 22% of total digital ad spend, with continued investment in Amazon, Shopify, Allegro, and Otto.

Top Industries by Ad Spend (Europe, 2025):

FMCG & Retail (18%): The biggest advertising sector, leveraging social media, influencer marketing, and omnichannel strategies to stay competitive.

Retail (17%): Heavy investment in e-commerce, personalization, and social commerce to capture consumer attention.

Telecommunications (8%): As 5G and mobile-first experiences redefine connectivity, telcos are doubling down on mobile ads and AI-driven targeting.

Entertainment & Media (7%): Streaming services, esports, and digital-first content drive ad investments in CTV, social video ads, and influencer marketing.

Travel & Leisure (7%): A booming sector post-pandemic, with brands focusing on experience-driven, social-first, and video-heavy campaigns.

Automotive (7%): Sustainability messaging and digital-first ad experiences are reshaping consumer perception.

Financial Services (6%): AI-powered ad strategies are transforming customer acquisition in banking, fintech, and insurance.

Media Breakdown:

Digital vs. Traditional: Digital will account for 72% of total ad spend, with print and linear TV seeing further decline.

Mobile vs. Desktop: 65% of digital ads will be served on mobile devices, reflecting Europe’s continued mobile-first consumer behavior.

Reach & User Penetration:

Mobile Internet Users: Expected to reach 680 million across Europe in 2025, making mobile the dominant digital advertising channel.

Internet Users: European internet penetration will exceed 85%, reinforcing the need for digital-first ad strategies.

Social Media Platforms: With over 450 million active users, social media remains the go-to channel for brand engagement and performance marketing.

Streaming & CTV Platforms: Continuing to expand, particularly in Western Europe, as consumers increasingly opt for ad-supported video content.

The European advertising industry is rapidly becoming digital-first, mobile-driven, and AI-powered. Brands that invest in CTV, influencer marketing, and retail media networks will be in the strongest position to capture audience attention, drive engagement, and achieve long-term growth.

From TikTok to LinkedIn, European brands are leaning into interactive, social-first strategies that prioritize community engagement over traditional ad formats.

2025 Trends and Insights, MENA View

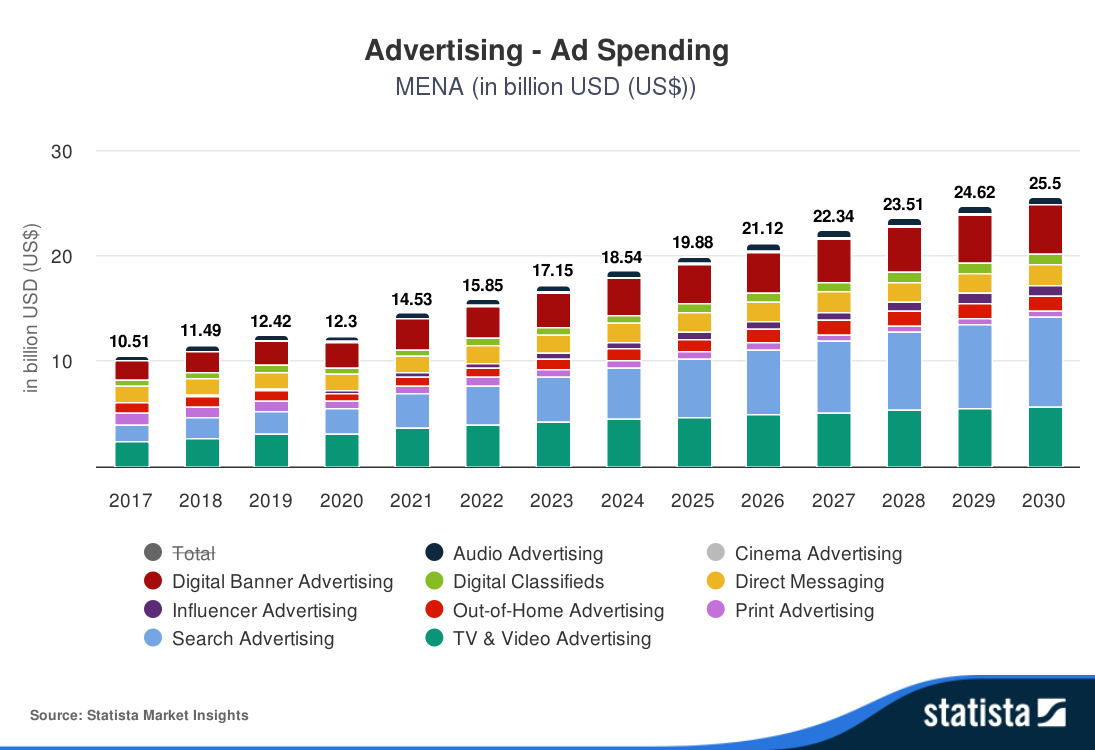

The Middle East and North Africa (MENA) advertising market is experiencing significant digital transformation, with online platforms taking center stage. While traditional advertising channels such as TV and print continue to hold relevance, digital accounts for 66% of total ad spend, driven by social media, in-app advertising, and retail media networks. Here’s what’s shaping MENA’s advertising landscape in 2025.

With social media ad spend surpassing $5.7 billion, MENA is proving that storytelling, cultural relevance, and influencer collaborations are the future of marketing success.

Advertising Spend Channels (MENA, 2025):

Digital Advertising: Dominating 66% of total ad spend, fueled by social commerce, search, and programmatic advertising.

Television Advertising: Holding 12% of total ad spend, TV remains a trusted channel in MENA, especially for government, retail, and telecom campaigns.

Out-of-Home (OOH) Advertising: Capturing 6% share, with digital billboards and transit ads continuing to grow in urban centers.

Direct Messaging & Radio: Combined, these formats account for 15% of ad spend, driven by localized and culturally relevant campaigns.

Top Digital Ad Spend Types (2025):

Search Advertising: Continues to be the largest digital ad segment, holding a strong share of total spend.

Social Media Advertising: Projected to reach $5.78 billion, reflecting the dominance of platforms like Instagram, TikTok, Facebook, and Snapchat.

Display & Video Advertising: Gaining strong traction, especially through YouTube, TikTok, and Connected TV (CTV) ads.

Retail Platform Advertising: Expected to reach $5.83 billion, driven by Amazon, Noon, and local e-commerce giants.

In-App Advertising: Growing steadily, projected at $5.06 billion, as mobile-first engagement continues to rise.

Rising Channels:

Programmatic Advertising: Expected to expand rapidly, optimizing ad placements through AI-driven bidding and first-party data.

Connected TV (CTV) & Streaming Ads: Increasing as MENA consumers shift to on-demand content, with ad-supported streaming services gaining traction.

Influencer Marketing: Brands are investing heavily in local influencers to enhance cultural relevance and drive authenticity in campaigns.

Retail Media Networks: Sponsored ads on platforms like Amazon, Noon, Carrefour, and Jumia are capturing a growing share of digital ad budgets.

Social Media Spend Share:

Social media is a key driver of digital ad spending, projected at $5.78 billion in 2025. Platforms like Instagram, TikTok, Facebook, and LinkedIn dominate, while Snapchat maintains a stronghold in key markets like Saudi Arabia and the UAE.

In-App vs. Mobile Web Advertising:

In-App Advertising: Expected to reach $5.06 billion, making up the majority of mobile ad spend, with high engagement in gaming, shopping, and entertainment apps.

Mobile Web Advertising: Retains a strong presence, particularly in search and display ad campaigns.

Retail & E-commerce Advertising Growth:

Retail Platform Advertising is projected to reach $5.83 billion, fueled by the rise of Amazon, Noon, Carrefour, and Souq.

E-commerce Advertising will continue growing, with brands shifting budgets from traditional advertising to online marketplaces and performance marketing strategies.

Top Industries by Ad Spend (MENA, 2025):

FMCG (30%): The largest advertising sector, with brands investing in omnichannel marketing, social media, and influencer partnerships.

Retail (8%): Increasing budgets in e-commerce-driven advertising and online retail promotions.

Telecommunications (8%): As 5G rollouts accelerate, telcos are focusing on mobile-first campaigns and AI-driven ad targeting.

Entertainment & Media (8%):Fueled by streaming, gaming, and esports, driving video ad and social engagement.

Pharma & Healthcare (8%): Brands are leveraging digital-first strategies, particularly in telehealth services and personalized wellness marketing.

Government (6%): Public sector ad spend is strong across MENA, with a focus on awareness campaigns and national initiatives.

Travel & Leisure (5%): A sector rebounding post-pandemic, with heavy investments in experience-based marketing, social ads, and influencer collaborations.

Media Breakdown in MENA (2025):

Digital vs. Traditional: Digital will capture 66% of total ad spend, with traditional media declining but still holding relevance in select sectors.

Mobile vs. Desktop: The MENA region is highly mobile-driven, with mobile advertising dominating digital channels.

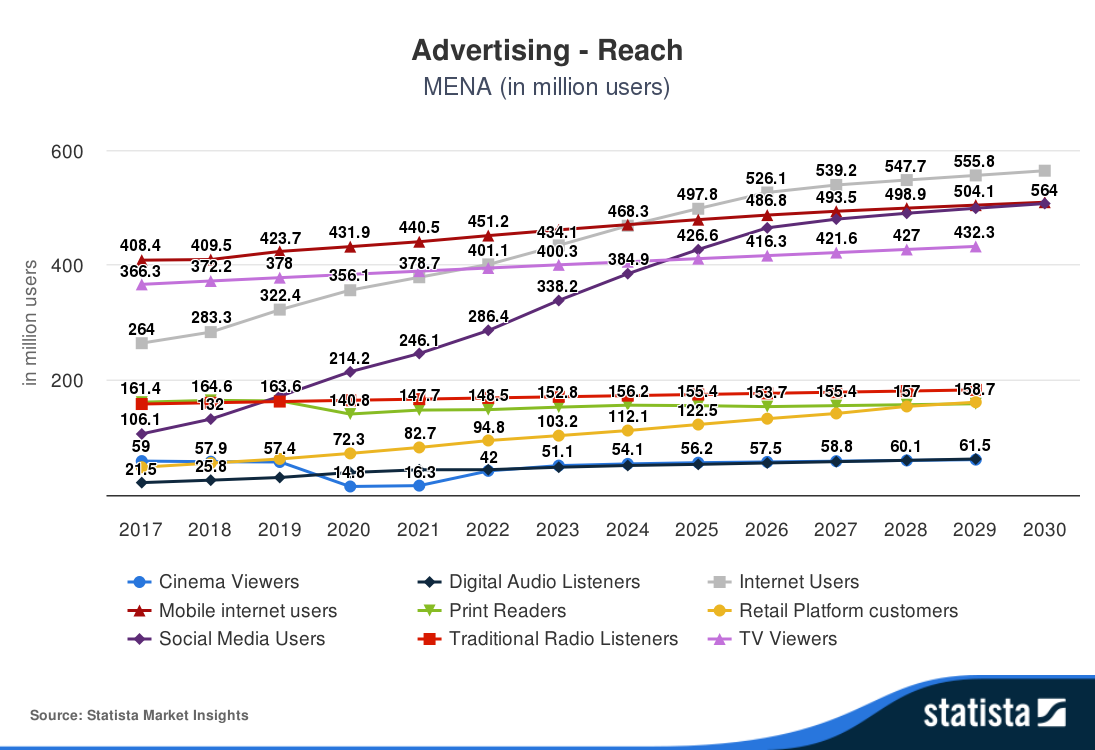

Reach & User Penetration:

Social Media Penetration: Continues to grow, with platforms like TikTok, Instagram, and Snapchat leading engagement.

Mobile Internet Users: A dominant audience segment, making mobile advertising the most effective digital channel.

Streaming & CTV Growth: Rising demand for on-demand and ad-supported streaming services, especially in urban and high-income markets.

MENA’s advertising landscape is mobile-first, digitally driven, and rapidly evolving. With CTV, influencer marketing, and retail media networks seeing major growth, brands that embrace personalization, AI-driven targeting, and localized engagement strategies will be best positioned for long-term success.

As e-commerce and retail media networks expand across MENA, brands are shifting budgets to digital-first platforms like Amazon, Noon, and Carrefour to capture the region’s rapidly growing online consumer base.

Why Business Leaders and Marketers Should Care About These Advertising Trends

In today’s fast-changing digital landscape, advertising is no longer just about buying media space, it’s about understanding where consumer attention is going and how brands can connect with audiences in the most effective way possible. The insights from Worldwide, Europe, and MENA advertising trends are not just numbers, they’re roadmaps for making smarter, more profitable decisions.

Why is this information crucial?

Staying Ahead of the Competition: The brands that win are the ones that adapt the fastest. Knowing where ad budgets are shifting, which platforms are gaining traction, and how consumer behavior is evolving gives businesses a competitive edge.

Optimizing Marketing Budgets: With digital ad spend surpassing 70% in most regions, companies can no longer afford to waste money on outdated tactics. Understanding these trends ensures that budgets are allocated where they’ll have the highest ROI, whether that’s programmatic advertising, influencer marketing, or Connected TV (CTV).

Consumer-Centric Marketing: The modern consumer is more digital, mobile, and social than ever before. These trends show where people are spending their time and attention, helping brands deliver personalized, high-impact campaigns that truly connect.

Navigating Industry-Specific Opportunities: Not all industries spend the same way. Whether you’re in FMCG, retail, finance, entertainment, or tech, these insights help tailor advertising strategies that align with sector-specific trends.

Capitalizing on Emerging Markets: Whether it’s retail media networks booming in MENA, social commerce dominating Europe, or AI-driven programmatic ads shaping the global landscape, understanding where growth is happening helps businesses expand strategically.

How Business Leaders and Marketers Can Benefit

Make Smarter, Data-Backed Decisions: Stop guessing where to put your ad spend. These insights give you a clear direction on where to invest, helping you pinpoint the most relevant opportunities for your market and industry. A data-driven strategy means better results, higher engagement, and stronger ROI.

Unlock New Revenue Streams: From influencer marketing to Connected TV (CTV) ads and AI-powered personalization, fresh, high-ROI opportunities are emerging. Businesses that adapt early will gain the most market share.

Maximize Ad Efficiency: Wasted ad spend is a thing of the past. By focusing on fast-growing channels like search, social media, and retail media networks, marketers can optimize campaigns, reduce inefficiencies, and drive customer acquisition more effectively.

Stay Ahead of Regional & Global Consumer Trends: What works in one market may not work in another, but the world is becoming more connected than ever. Trends now cross borders at lightning speed through virality and social media. Keeping an eye on both local and global shifts will help you anticipate consumer behavior before your competitors do.

Future-Proof Your Business: The digital landscape is evolving at breakneck speed. Companies that embrace automation, AI-driven targeting, and omnichannel strategies will be the ones that thrive in the long run. Those who ignore these changes will struggle, and ultimately pay the price.

Because attention is currency, and the way people consume content is changing faster than ever. The brands that understand these shifts and adapt accordingly will be the ones that lead their industries, drive more sales, and build stronger customer relationships.

🤔 Which advertising trend do you find the most exciting or impactful for your business? Are you already experimenting retail media or CTV ads? Drop your thoughts in the comments, I’d love to hear what’s working (or not) for you!

📌 Think this could help someone in your network? Tag them and let’s keep the conversation going.

♻️ If you found this article insightful, pass it on, someone you know might benefit too.

If you’re looking to navigate the ever-evolving advertising landscape or wondering how to make the most of your ad strategy in 2025, Reach out

If you enjoyed this piece, you’ll love my weekly Monday drop, decoded Thoughts & Growth Hacks on Business, Entrepreneurship, Wellbeing & Winning in Life, straight to your inbox. Sign Up Today